Flash finding: Assessing the concentration risk of the Mylan/Greenstone marriage

On June 30, 2020, Mylan announced that its shareholders had unanimously approved its merger with Pfizer’s Upjohn, to form a new company called Viatris. One asset within Upjohn is Greenstone, a generic manufacturer that focuses on authorized generics. While we are in no way going to attempt to analyze the entirety of the massive Mylan/Upjohn merger, we were interested to better understand the concentration risk on the U.S. generic marketplace by the marriage of Mylan and Greenstone.

The good news is that we already have a tool to figure this out. It’s called the Medicaid Drug Market Share Dashboard, and using CMS State Drug Utilization Data (SDUD), it tells us exactly who has what market share in Medicaid for every drug. While not a complete assessment of our nation’s generic manufacturer market share, the Medicaid data provides a substantive snapshot of the overall market distribution for the production of each generic drug.

Let’s put the Mylan/Greenstone combination to the test and see what we can unearth.

What we found

Based on the prescription volumes reflected in the SDUD, Viatris will be responsible for nearly 1 in every 20 prescriptions dispensed in Medicaid. In 2019, there were nearly 700 million total Medicaid prescriptions dispensed. Of those, 19.1 million were for products dispensed under a Mylan label (3% of total), and 5.6 million (1%) were under a Greenstone label. That means Viatris will sell approximately 24.7 million prescriptions through Medicaid, equivalent to 4% of all prescription volume.

What we found when we dug deeper

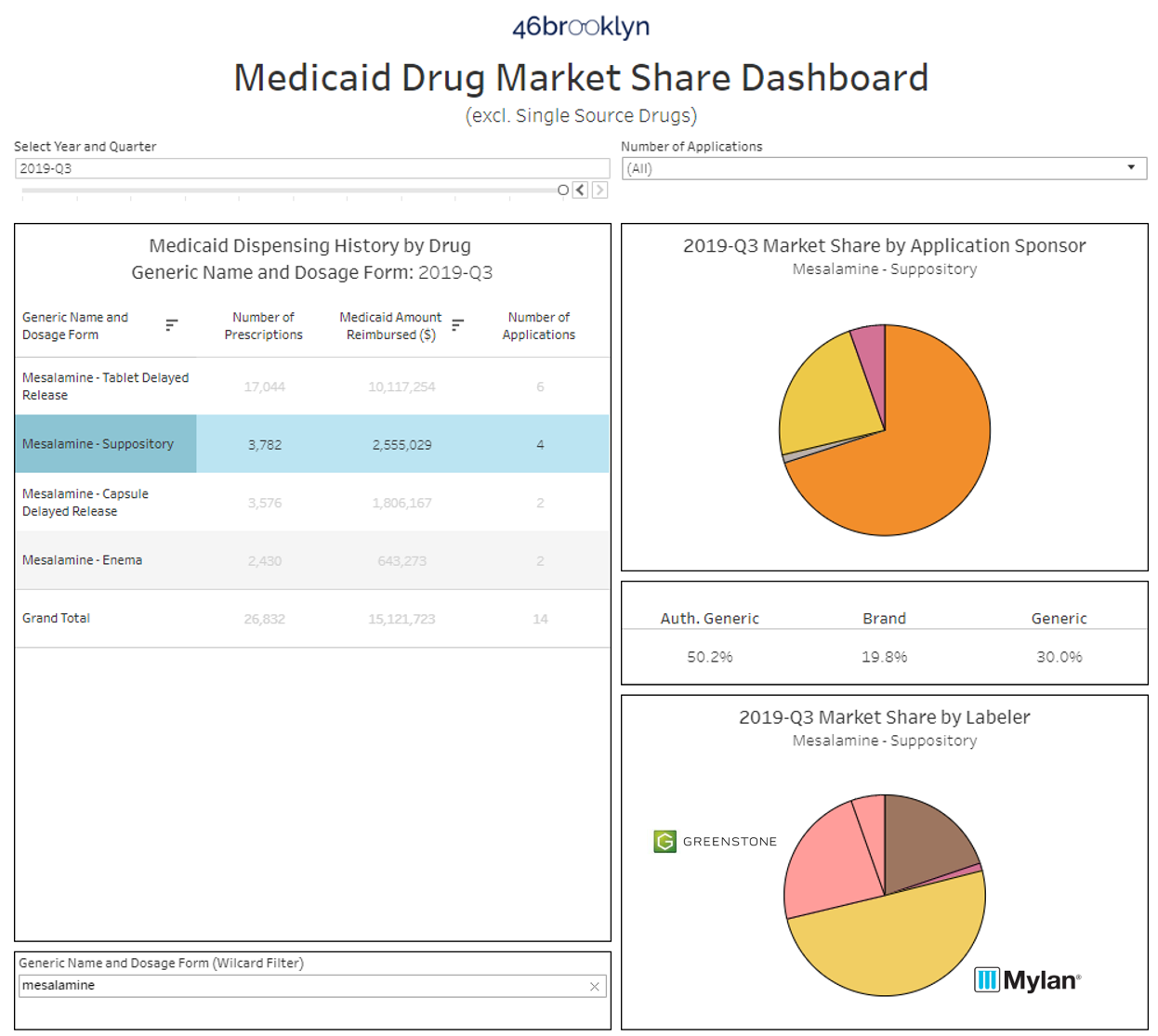

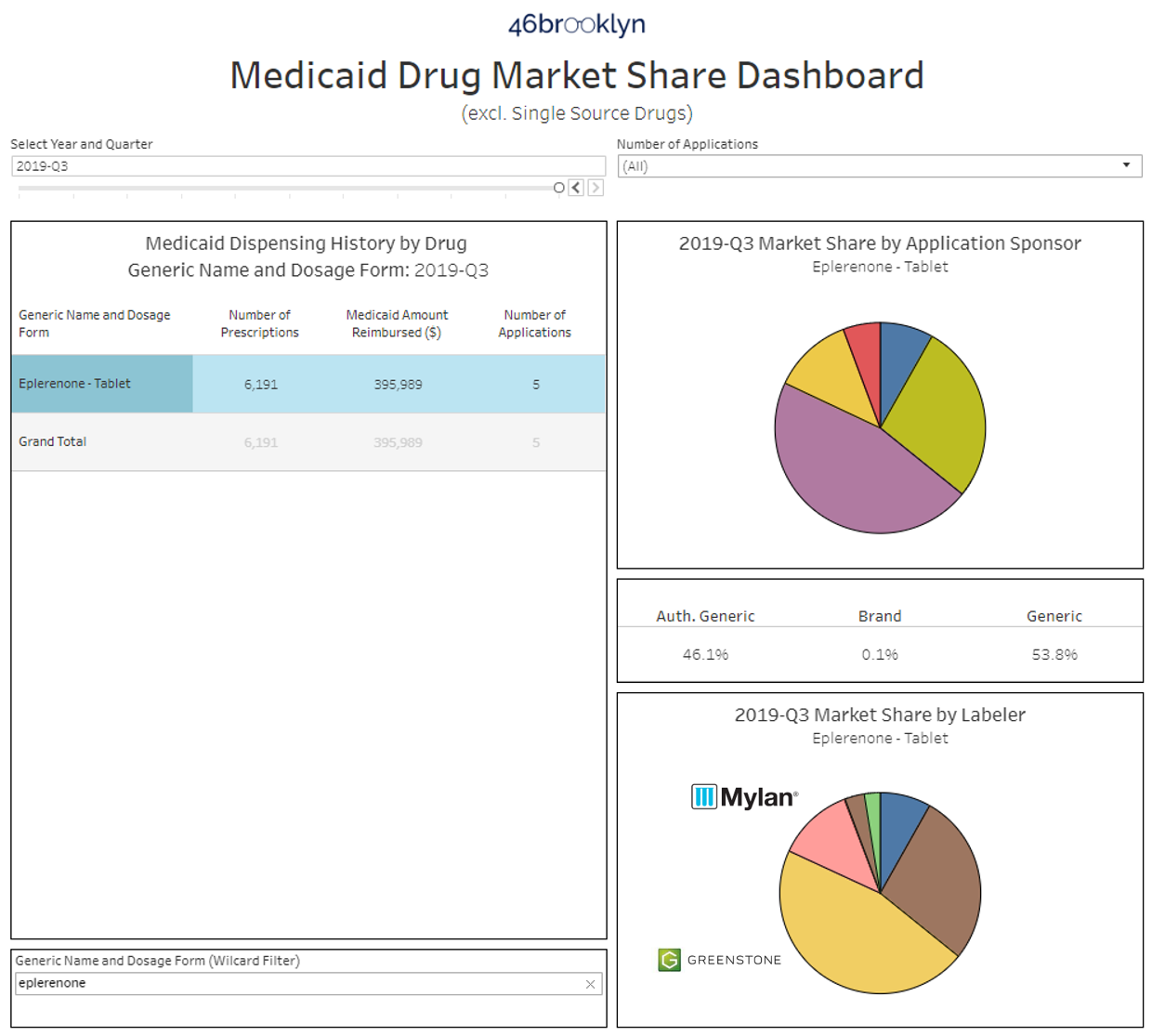

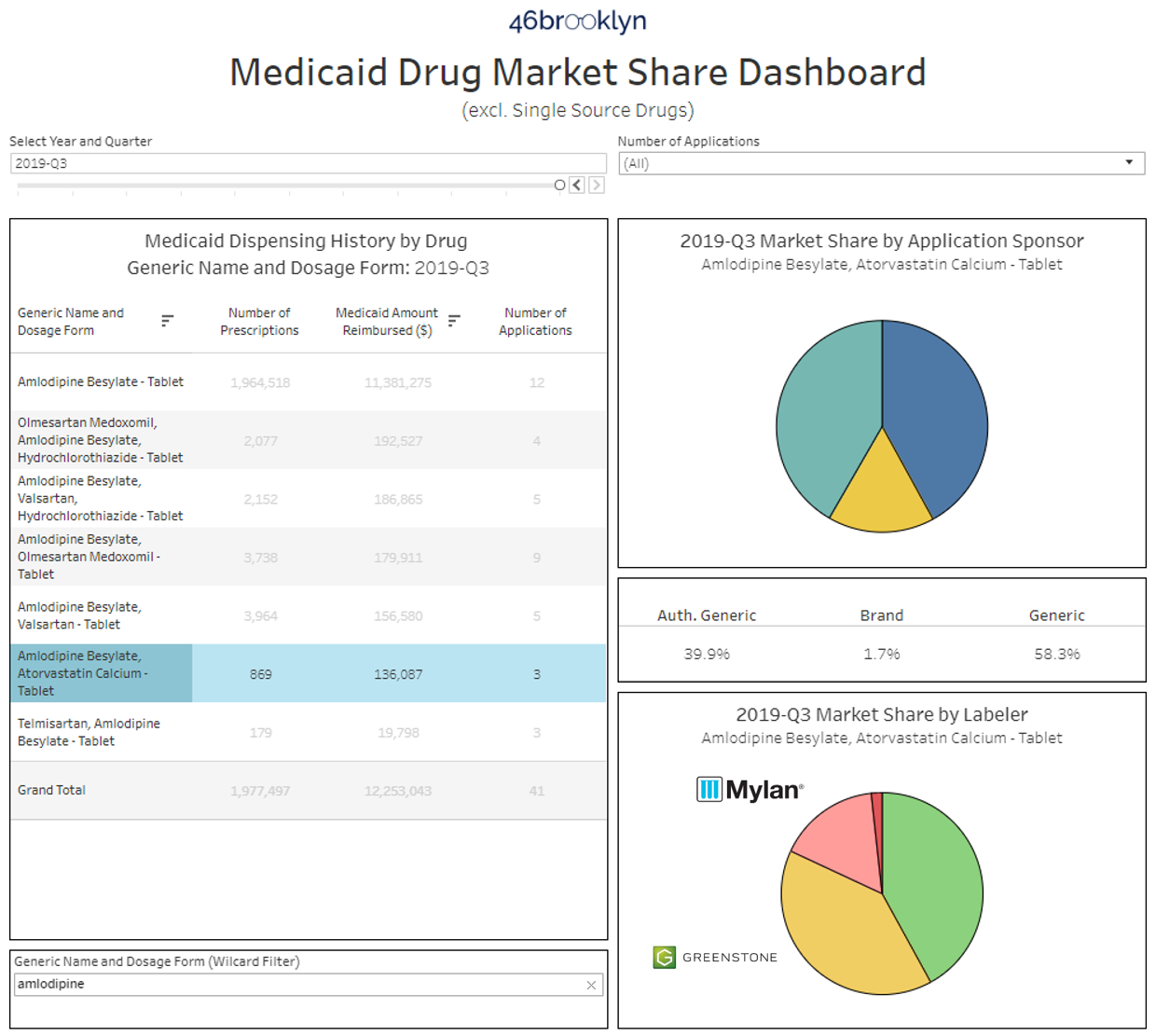

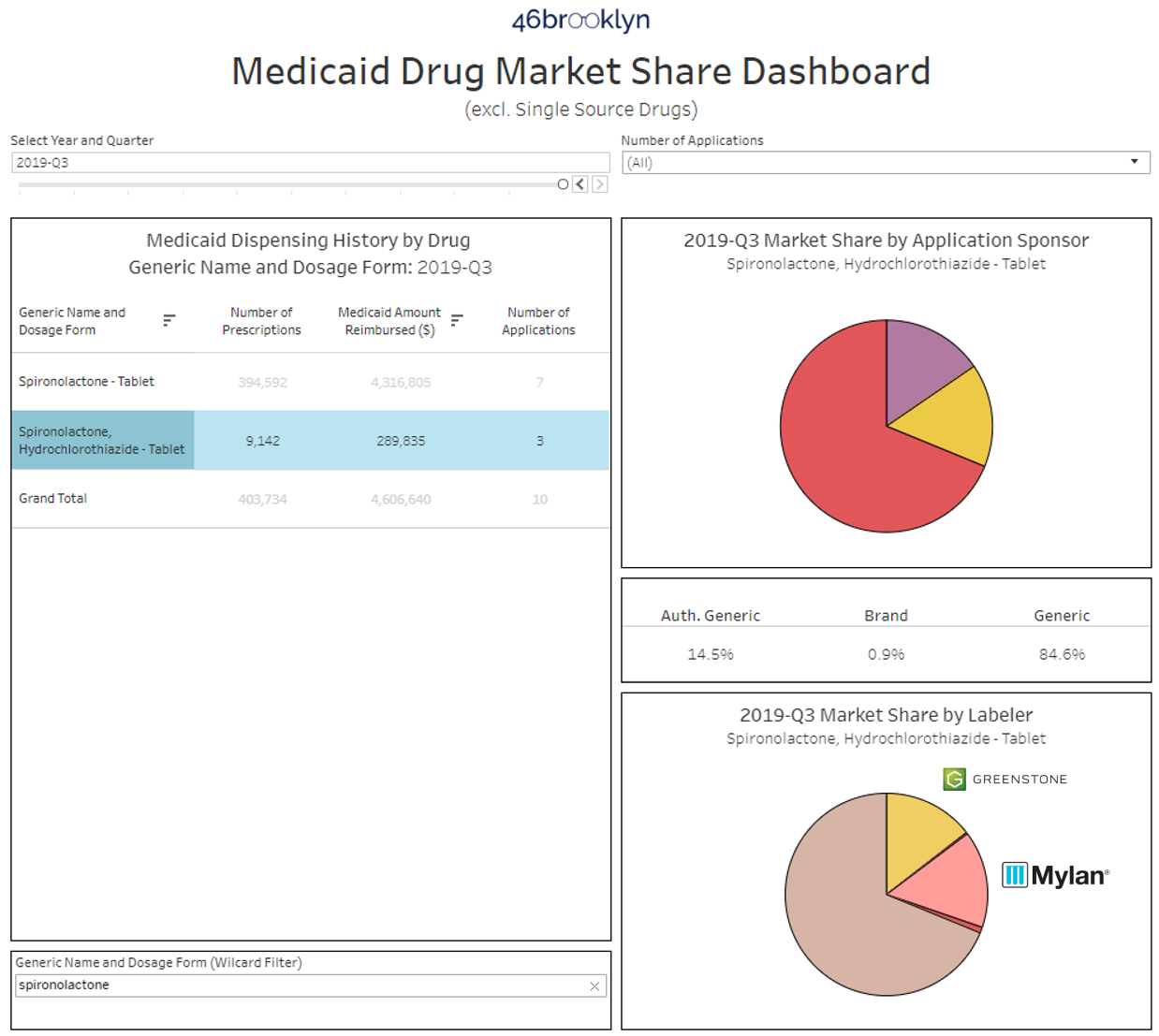

But that finding is not necessarily a problem. It’s more important to keep an eye on drugs whose manufacturer concentration is set to climb markedly due to this marriage. To measure this, we looked for drugs where Mylan and Greenstone both had over 10% of Medicaid volume in 2019 for the same active ingredient and dosage form. Five product groups met this criteria, summarized in Figure 1 below and shown in the Medicaid Drug Market Share Dashboard chart gallery presented afterwards.

Figure 1

Source: Data.Medicaid.gov, Elsevier Gold Standard Drug Database (GSDD), 46brooklyn

FWIW

While this isn’t ideal if you are taking one of these five drugs, we were pleasantly surprised to have only found five “at risk” drugs, especially in light of our findings that Mylan and Greenstone sold more than 550 different generic drugs into Medicaid in 2019.

However, this isn’t the end of this story. Cut-throat competition has driven generic prices on most drugs down to just pennies. Whether legally (through consolidation) or illegally (through price fixing), the generic drugmakers are trying to fight back against this dynamic to carve out more sustainable profits. This is out of anyone’s direct control – simply a byproduct of a mature, highly-commoditized industry. But the data is available to better understand the risk. As such, 46brooklyn’s Medicaid Market Share Dashboard should be a core part of your toolbox to gather the facts on generic drug concentration risk. While the initial data suggests that the risks of this merger for impacted generic drugs could be relatively small, this type of data is essential for evaluating the potential impact of future drugmaker mergers.

Thanks to Ed Silverman at STAT News for also highlighting information from our Medicaid Market Share Dashboard in his recent piece on dexamethasone shortages. For those interested, the Medicaid data shows that Hikma Pharmaceuticals has a whopping 99.77% of the market share of Medicaid prescriptions for dexamethasone tablets, highlighting an extreme example of concentration risk.