On August 20, 2018, the U.S. Department of Health and Human Services (HHS) released an analysis of the accomplishments that the Trump administration has achieved in the first 100 days since the release of the President’s American Patients First Blueprint to lower prescription drug prices. The HHS Report on 100 Days of Action on the American Patient First Blueprint provides some interesting insight into the Trump administration’s progress on delivering on their promise of lower drug prices. While there is a lot that needs deciphering, HHS made two very significant claims in this report. They assert that over the first 100 days since the Blueprint's release there have been significantly less brand-drug price increases, and significantly more generic and brand price decreases. After some careful number-crunching and analysis, we can now tell you where we believe the administration seems to be making headway and where things still seem incomplete. More importantly, we hope we can provide some better clarity into whether or not any current actions have directly impacted lower drug costs. Check out our newest research that shows what really happened to drug prices in the first 100 days since the release of the White House blueprint.

Read MoreEach week CMS posts updates to its National Average Drug Acquisition Price (NADAC) database. It quietly happens each Tuesday, without much fanfare. If you check this weekly, you likely have noticed that most weeks, not much changes, but then there is one week each month where there is a lot of pricing action, almost exclusively within generic drugs. We call this “survey results week,” the week when CMS publishes changes to thousands of NDCs based on the survey results from prior month invoice costs reported by pharmacies all across the country. The August survey results have been released, and there has been a lot of pricing movement. Generic Viagra prices are in freefall, and generic Ziac prices are soaring, but based on our aggregate analysis, it looks like this month’s overall drug costs actually decreased!

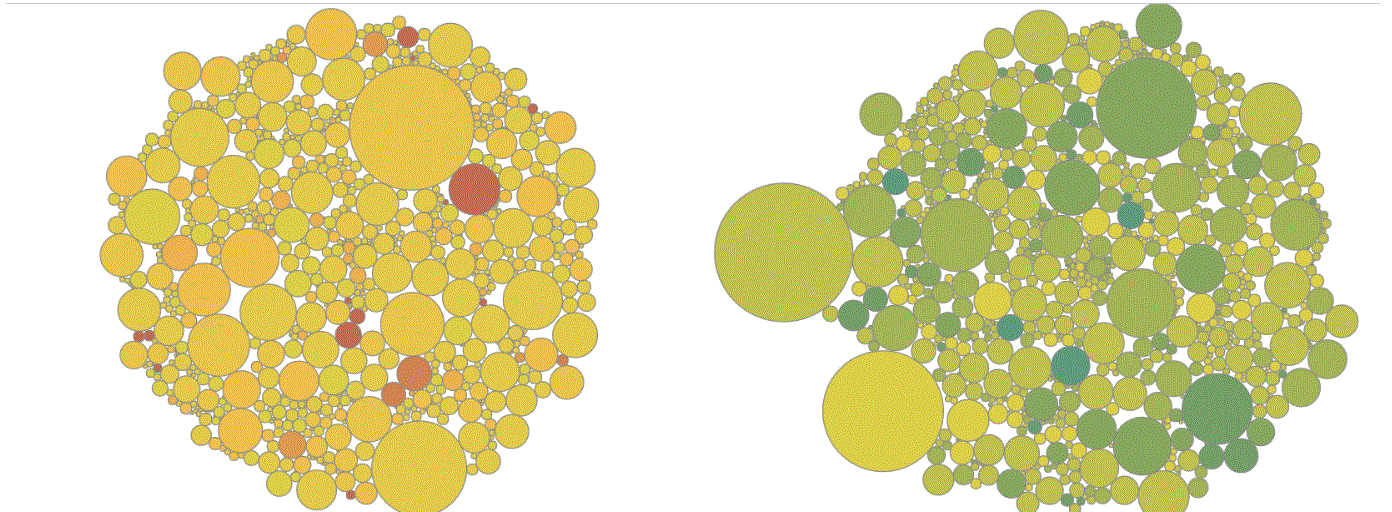

Read MoreWe are pleased to announce a new visualization tool that shows what prescription drugs that state Medicaid programs are purchasing. This new 46brooklyn State Utilization Dashboard will now provide an easy way to see the degree with which each prescription drug is being dispensed to Medicaid patients on a state-by-state basis. This new dashboard will show unprecedented levels of detail in what state Medicaid programs are paying for. As taxpayers, we believe you deserve to know what you bought, and to also see how much you spent. There are a myriad of ways this new tool can be used, so hopefully you can use it to answer every question you ever (or never) had.

Read MoreIt is well-known that competition in the generic manufacturer marketplace drives drug prices down considerably. Plaquenil, a brand-name drug that has been on the market since 1955, eventually saw generics enter the market almost a quarter of a century ago. By all accounts, generic Plaquenil – known as hydroxychloroquine – had become a very affordable drug at approximately 10 cents per pill. But FDA actions quickly dried up the supply of the drug, causing prices to balloon more than 2,500%. 46brooklyn’s newest drug pricing report examines how state Medicaid programs were impacted by this price spike, and how some states continued paying elevated rates even after the price came crashing back down.

Read MoreBased on user feedback, we've made some enhancements to the Medicaid Drug Pricing Heat Map that hopefully will both improve the user experience and quality of the data. We've also posted an FAQ page with answers to some of the common questions we have received over the last week.

Read MoreDrug prices are complicated. Let’s simplify them. Today, we are pleased to announce the launch of 46brooklyn, a research and analytics project to help bring transparency to prescription drug prices and provide patients and key stakeholders the tools necessary to hold the system accountable.

Read More