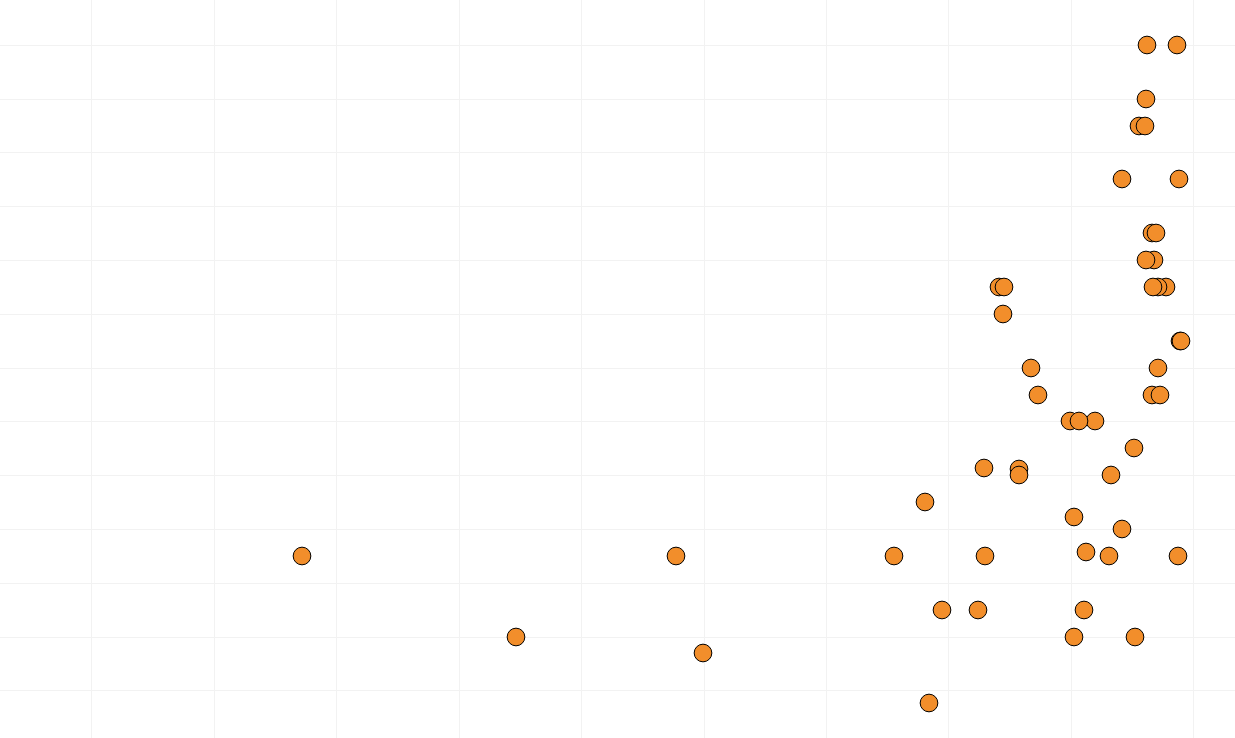

CMS published their latest National Average Drug Acquisition Cost (NADAC) survey results today, and they've given us a lot to be thankful for! Applying the latest pricing changes to Medicaid's 2018 drug utilization mix results in $169 million of annualized savings on generic drugs. Moreover, we got both better "quantity" and "quality" out of this update. In other words, more generic drugs went down in price (quantity) and of the ones that went down, a lot more went down by a meaningful amount (quality).

Read MoreAverage Wholesale Price (AWP) is a meaningless benchmark price for generic drugs, but despite its lack of substance, AWP-based payment models just won't go away. Unfortunately the contractual reliance on a benchmark that has no relevance to actual price makes it very difficult for the payer to know if they are getting a good deal or not. They are left to pay a fixed discount off of an unknown combination of meaningless, non-market-based, numbers. Seems like that would be tough sell, but this is drug pricing we are talking about, so of course, it's the norm. For the past couple months, we compiled data to create a visualization to help illustrate the problem that arises by anchoring generic drug costs to AWP. The finished product is embedded in this latest report "Inside AWP: The Arbitrary Pricing Benchmark Used to Pay for Prescription Drugs," along with our observations and analysis.

Read MoreOn October 24, 2018, CMS released an update to all State Utilization Data posted on data.medicaid.gov. Most notably, the 2018 database was rolled forward to include Q2 2018 data. As such, we have released updates to all 46brooklyn dashboards posted on our visualizations page. In conjunction with this update, we have also published a new dashboard that allows the user to identify the top 20 drugs in each state’s managed care (MCO) program that have a markup (MCO paid amount less NADAC ingredient cost) of over $20 per prescription.

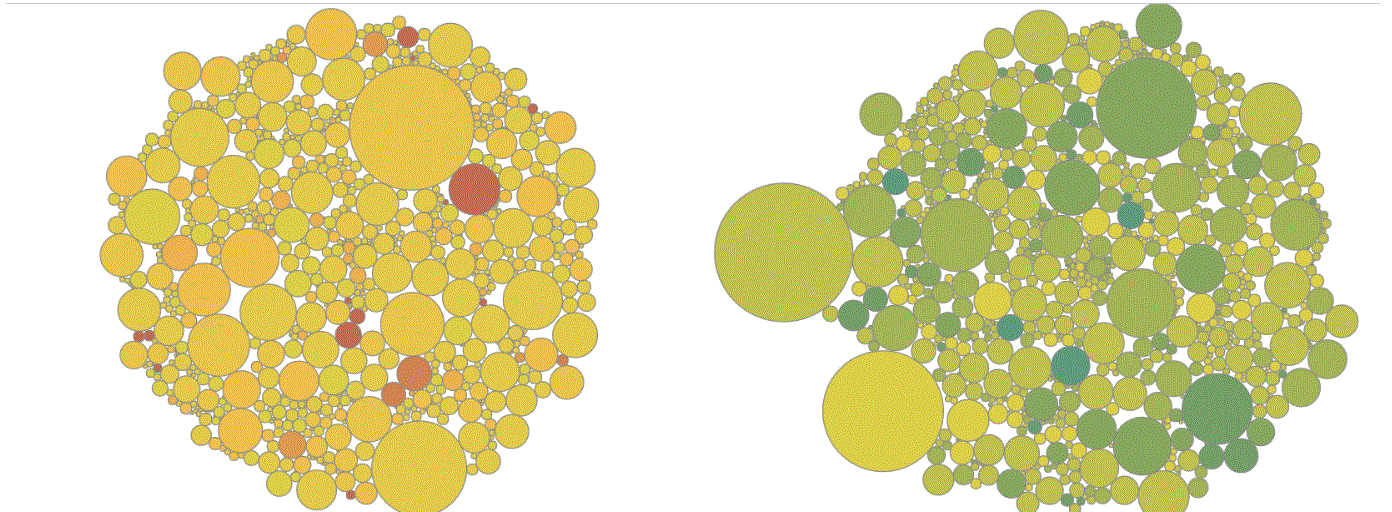

Read MoreIt’s NADAC survey results week, which means it’s time for our third installment of “what happened to generic drug prices last month.” It looks like there was a bit of net deflation, but overall, there were an equal number of price increases and decreases. But as always, the details matter. Check out our latest drug pricing report for a lot of important updates, plus an updated NADAC Packed Bubble Chart!

Read MoreAfter Bloomberg put drug price markups on the map, we decided a deeper dive into markups was warranted to see which drugs were getting overinflated and which drugs were not. To sort things out, we built a new visualization dashboard to compare drug markups between state Medicaid programs. We call our creation the “Medicaid Markup Universe.” In this new visualization tool, we found a disturbingly large difference in drug markups across generic drugs in state Medicaid managed care programs, resulting in a slew of warped incentives that pressure supply chain members to value certain medications over others, and thus, certain patients over others. Check out our newest visualization tool and read our latest drug pricing report.

It’s NADAC survey results week, which means it’s time for our second installment of “what happened to generic drug prices last month.” Good news. Prices are dropping significantly. Check out our latest drug pricing report for lots of important updates, plus an updated NADAC Packed Bubble Chart!

Read MoreEarlier this week, Bloomberg reporters Robert Langreth, David Ingold, and Jackie Gu published their results of a fascinating deep dive into Medicaid generic drug prices in their article, “The Secret Drug Pricing System Middlemen Use to Rake in Millions.” The piece did an excellent job explaining the ins and outs of the hidden pricing spreads that exist on generic drugs, and it featured some intuitive visualizations that helped educate readers who may not have been familiar with these little-known drug price tactics. Bloomberg’s methodology was nearly identical to what we used to create our Medicaid Drug Pricing Heat Map, so not surprisingly, the results were very similar as well. The analysis conducted by Bloomberg also integrated the results of a recent report from the state of Ohio's Auditor, which found that in a one-year span, PBMs pocketed more than $224 million dollars in spread pricing. Armed with this data, we set out to discover if we could deduce what pharmacy margins were over that same time period in an effort to peel back new layers of the onion and provide better information on where the money is going. Check out our newest drug pricing report to learn more about where the money is going on hidden prescription drug markups.

Read MoreOn August 20, 2018, the U.S. Department of Health and Human Services (HHS) released an analysis of the accomplishments that the Trump administration has achieved in the first 100 days since the release of the President’s American Patients First Blueprint to lower prescription drug prices. The HHS Report on 100 Days of Action on the American Patient First Blueprint provides some interesting insight into the Trump administration’s progress on delivering on their promise of lower drug prices. While there is a lot that needs deciphering, HHS made two very significant claims in this report. They assert that over the first 100 days since the Blueprint's release there have been significantly less brand-drug price increases, and significantly more generic and brand price decreases. After some careful number-crunching and analysis, we can now tell you where we believe the administration seems to be making headway and where things still seem incomplete. More importantly, we hope we can provide some better clarity into whether or not any current actions have directly impacted lower drug costs. Check out our newest research that shows what really happened to drug prices in the first 100 days since the release of the White House blueprint.

Read MoreEach week CMS posts updates to its National Average Drug Acquisition Price (NADAC) database. It quietly happens each Tuesday, without much fanfare. If you check this weekly, you likely have noticed that most weeks, not much changes, but then there is one week each month where there is a lot of pricing action, almost exclusively within generic drugs. We call this “survey results week,” the week when CMS publishes changes to thousands of NDCs based on the survey results from prior month invoice costs reported by pharmacies all across the country. The August survey results have been released, and there has been a lot of pricing movement. Generic Viagra prices are in freefall, and generic Ziac prices are soaring, but based on our aggregate analysis, it looks like this month’s overall drug costs actually decreased!

Read More